Personal Pension Management

It’s all about Pension Management. Many Americans will have saved $200,000 - $1,000,000 when they decide to ‘Retire’. For most, they will need to draw income for the remainder of their lives. Pension Management requires a higher degree of skill and attention that traditional account management.

Retirement savings converted into retirement income becomes a pension fund.

Americans Retirement is focused on providing retirees with the same services as Corporate Pension Funds.

Americans Retirement Framework for Personal Pension Investment Management

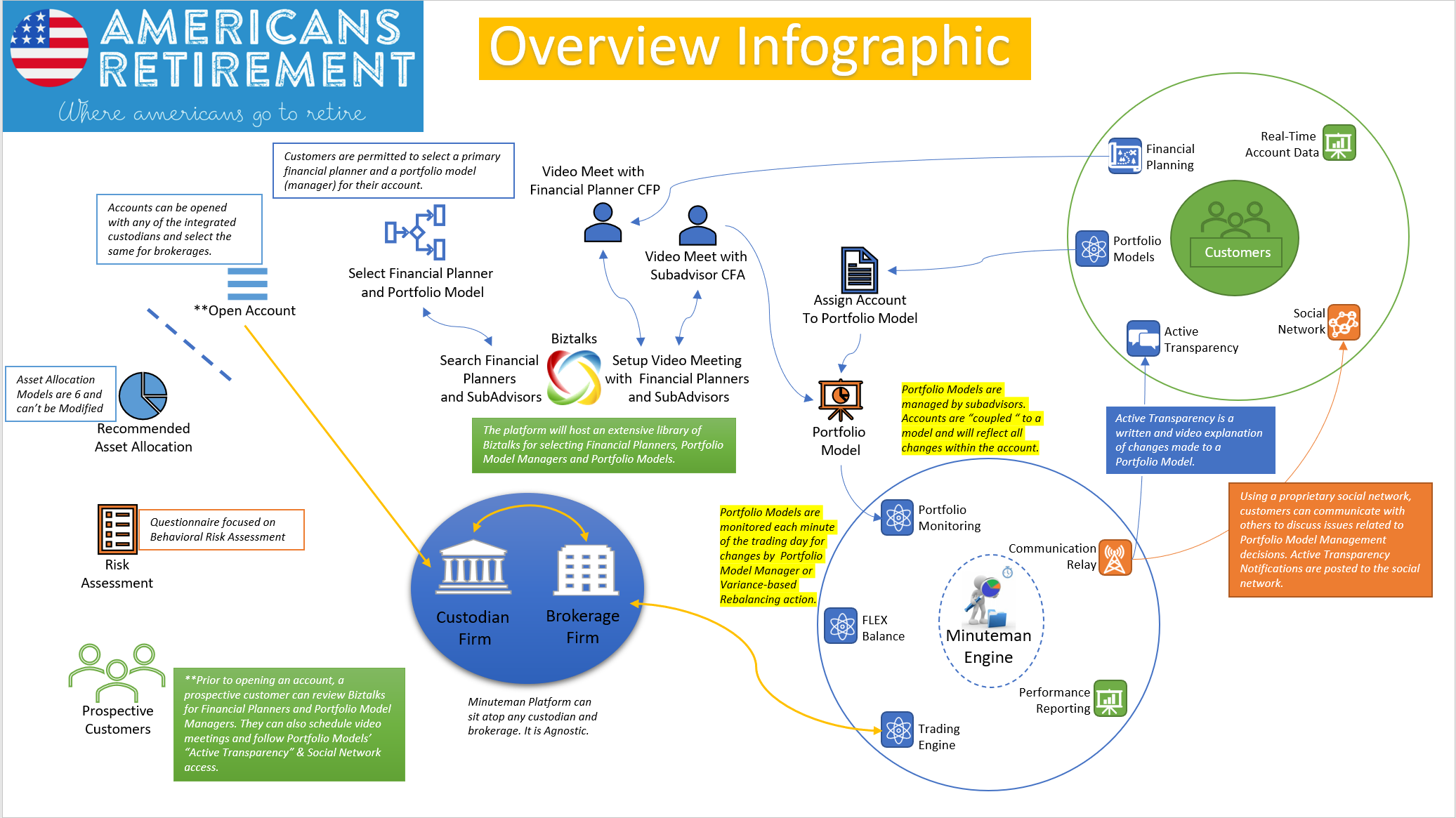

Governance Structure - Americans Retirement governs almost every aspect of the services performed for our investors.

- Asset Allocation Recommendations generated by Proprietary Risk Assessment’

- Financial Planners (required to complete the Americans Retirement Personal Pension Consultant Certificate. All Interactions are required through our communication portal and recorded for monitoring. They will need to be in good standing with other associations such as Institute of Certified Financial Planners or the American College.

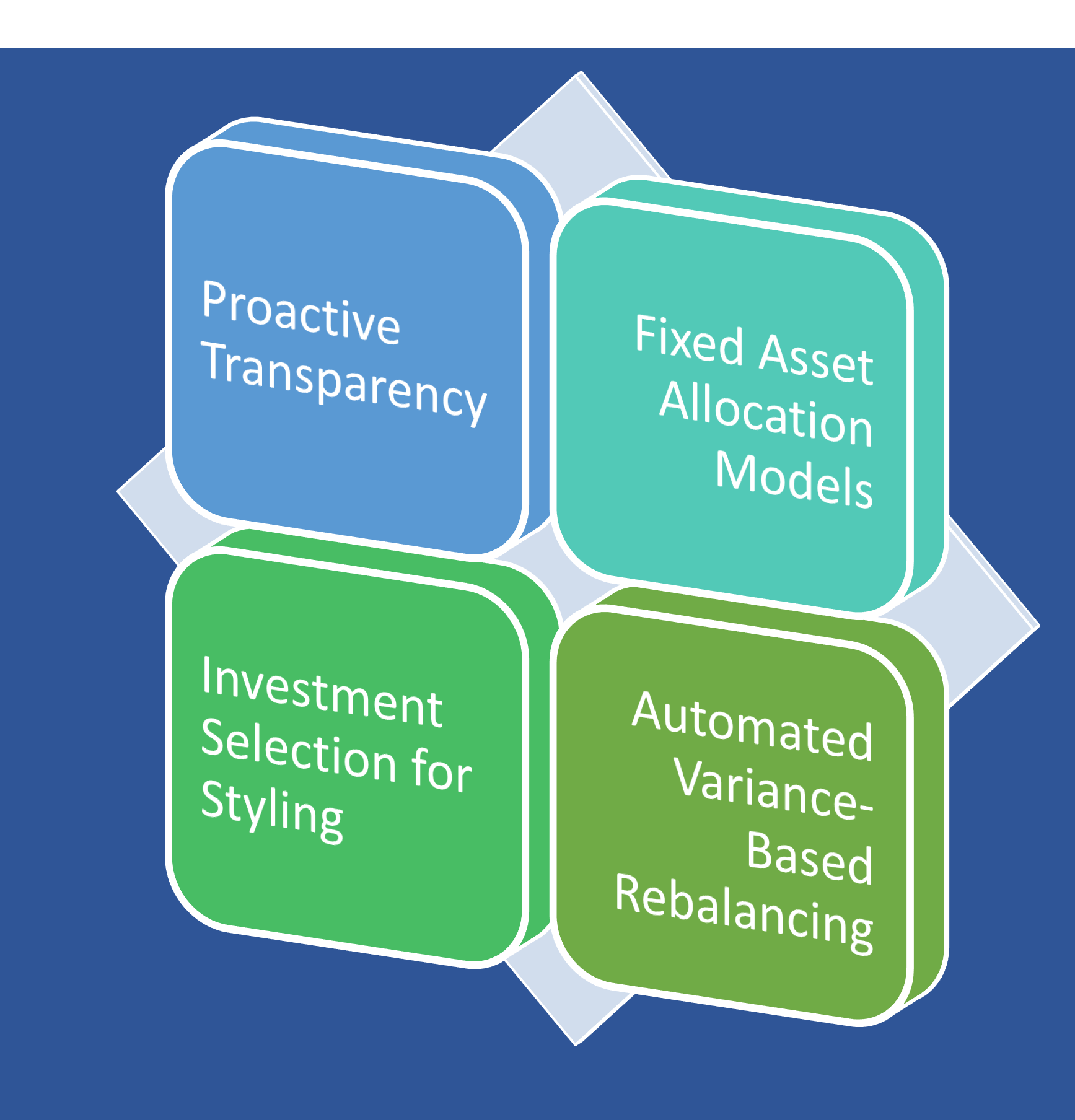

- Investment Managers – Securities transactions a monitored for consistency with the portfolio model ‘Postures’. Each ‘proactive transparency’ communication is required prior to its dissemination.

- Social Media Platforms are monitored for in appropriate communications and the integrity of content shared.

- Available Investments within the universe of options for Security selection are reviewed Quarterly by the Americans Retirement Investment Committee.

Investment Policy - Each Personal Pension Account Owner will receive a custom tailored Investment Policy Statement that defines the lists the investor’s investment objectives, along with his time horizon. For example, an individual may have an IPS stating that by the time they are 60 years old, they want to have the option to retire, and their portfolio will annually return $65,000 in today's dollars given a certain rate of inflation. A well-conceived IPS also delineates asset allocation targets as well. For instance, it specifies the target allocation between stocks and bonds, further breaking down the target allocation into sub-asset classes, such as global securities by region. The targets should then have a minimum and maximum deviation that, when exceeded, will trigger portfolio rebalancing.

Investment Management – With the elimination of Asset Allocation modifications and an Investment Universe of Available Investments dictated by the Americans Retirement Investment Committee, Investment managers provide guidance for their Portfolio Models. Investment Managers develop “Postures” for their individual Portfolio Models and manage the individual investments for each asset class. While Investment Managers modify their models, the proprietary Minuteman Trading Engine implements the appropriate investment trades to mirror the Portfolio Model.

Risk Management – Investment Risk can be defined as an aggregation many individual risks. The Americans Retirement Investment Platform incorporates a number of measures to control many risks through the process of investment selection by the Americans Retirement Investment Committee. Our risk management doesn’t stop there, we employ a proprietary portfolio monitoring system Minuteman GuardRails. As a cornerstone of the Americans Retirement Investment Platform, Asset Allocation is a primary risk diversifier and Minuteman GuardRails are minute-by-minute measurements of changes to asset class weightings as compared to the ‘Target Weightings’. Investment Managers stipulate the range of variances from the Target and Minuteman GuardRails perform portfolio model rebalancing activities “AUTOMATICALLY”.

Performance Measurement - GIPS Standards Performance Reporting based on the GIPS as detailed by the Institute of Chartered Financial Analysts. The GIPS standards are ethical standards for investment performance presentation to ensure fair representation and full disclosure of investment performance.

Accounting & Reporting – Americans Retirement is in a constant state of monitoring all activities within the platform. Whether it is meetings scheduled or conducted with investors and Private Pension Consultants or Trades performed from an automated rebalancing, our system is measured the expected vs the actual. When differences are greater than acceptable, the proper channels are alerted and issues remedied. Internal reporting is generated daily for review.

Information Technology – Americans Retirement is built a top of a modern cloud ecosystem of distributed systems, with redundancy and high-availability as top-tier concerns. Taking advantage of the latest cloud architectures and resources, investors can benefit from customer centric solutions.

Investing Cornerstones

- Minuteman Platform Biztalk