An innovation 30 years in the making.

While technologists spend time and money proving their many theories, our focus is to enable people to do what they have been doing for many, many years. Although the financial services industry has been slow to adopt modern technologies, believing technology will replace advisors is not logical.

The development of this platform came from decades within the Financial Services Industry.

Need for Professional Retirement Planning

Retirement Planning has become a far more complex endeavor than when retirees collected interest from their Certificates of Deposit that supplemented their Social Security Income and pension. Today, retirees face a storm of variability and uncertainty.

Navigating the storm of variability requires much more time and attention to the addressing risk of many contributors, not simply the possible variance of a portfolio investments that derive a possible average rate of return. We believe that professional retirement planning must include advice on preparing for a complete list of impact variables. Some of these include:

- Cost of Living (inflation)

- Medical Issues

- Support Services (need for assistance)

- Changes In Lifestyle

- Changes in Living Accommodations

- Death

- Family Needs

We believe that only a trained professional can evaluate the applicable risks for retirees. Although computer algorithms are good at ‘crunching numbers’, their results are only as good as the inputs: Garbage in Garbage Out. A trained professional can insure that the inputs are meaningful so that the outputs are equally meaningful.

Need for Professional Investment Management

Our professional investment managers provide the very important and required service of investment selection. Unlike many other investment services where investment managers will modify asset allocation models, since our asset allocations models are fixed, our investment management professionals focus on the investments selected for each of their portfolio models.

Investment management teams will select the proper investments for the posturing of their portfolio models. Posturing is a term we use for the design styling of a portfolio model’s discipline. Our investment professionals design portfolio models for some of the following postures:

- Inflation Defense

- Economic Growth

- Domestic Recession

- Global Economic Pressures

- Pandemics

As you can see from the list above there can be any number of different Postures that investment selections can be assembled. Investment managers will select from securities selected by our investment committee. Our Investment Committee monitors and reviews investments for inclusion within each of the 7 asset classes.

Leveraging Technology

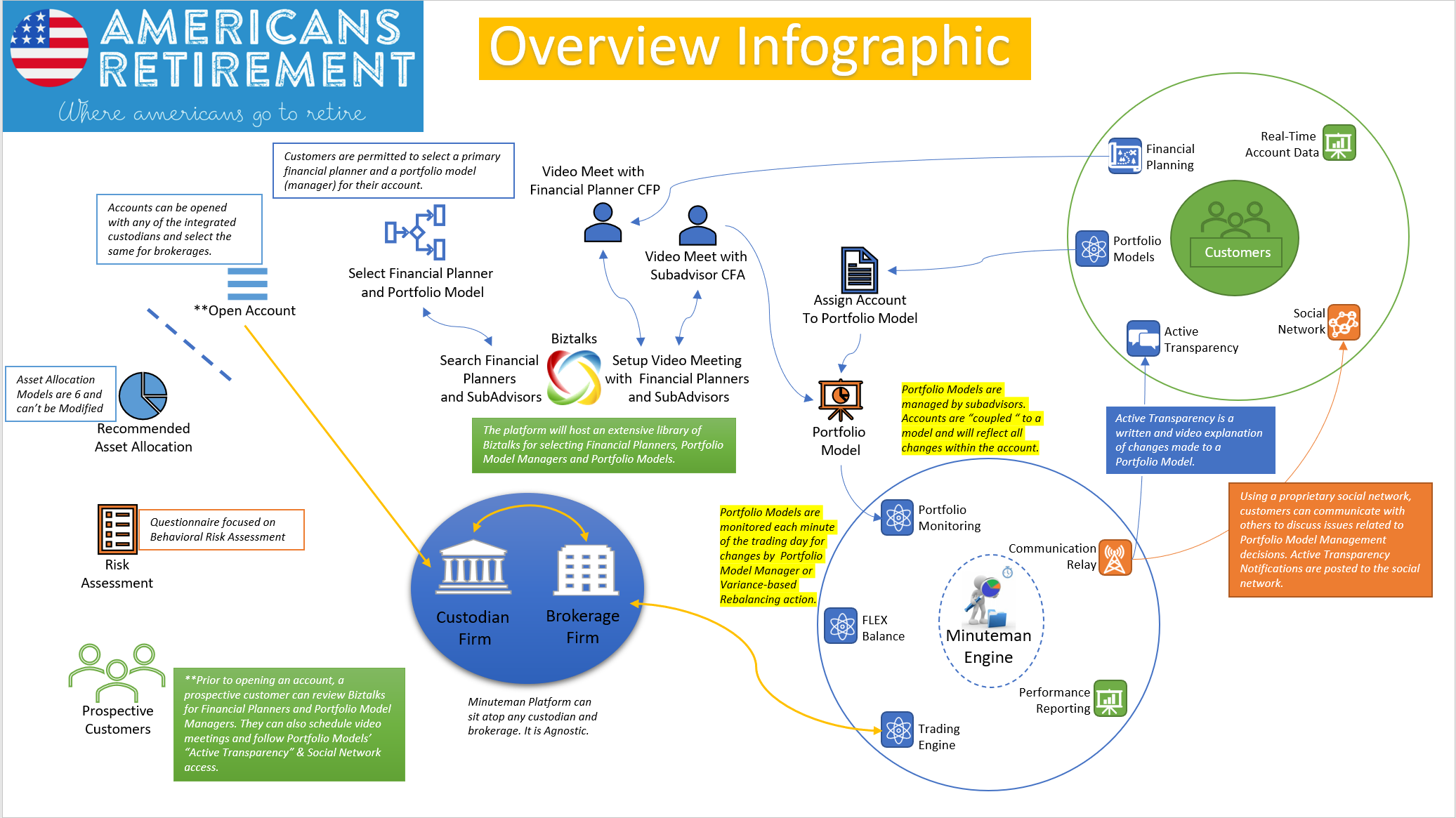

Advisory businesses are based on human connections. Technology needed to be designed to help people to find those who can provide the required advice. Bringing people closer together is the internet's greatest strength. We built technology solutions to help advisors to present themselves in a compelling manner that demonstrates their value. Now if prospective decides to schedule a video meeting with an advisor (no matter the time or day), they don't need to wait until the advisor is in the office, they can do so for a time convenient to both: Advisor and Client.

We develop workflows that make it easy for a consumer to make an appointment or transact business with advisors. The workflows seamlessly integrate communications between many world class technologies to facilitate robust yet simple user experiences.

The Mission of Americans Retirement

Currently, technology exists that can assist in guiding an investor through a process of identifying proper asset allocations of investments. However, the solutions provided by Broker / Dealers require the investor to select their own investments and then implement their decisions by buying and selling securities.

Investors can log in and see a plethora of information about their account, but who will monitor it for changes in the account composition? Can’t technology assist in alleviating the investor from this burden? Then there is the matter of evaluating investment performance and decisions made by portfolio managers charged with the management of individual asset class investments. Again, investors can access a plethora of information but without being immersed in the financial events driving markets, how can any decision be made with confidence? Where is the guide?

PROVIDING GUIDANCE

Investors need the ability to examine their goals and propensity for risk. Inherently, the process of evaluating perceptions of risk and exploring their feelings through a questionnaire is a familiar process that will yield results driven by their inputs. The feedback from the questionnaire is derived from academically accepted practices and theory, so it is not something that will contradict or question their typical belief system. The prescribed asset allocation for their investments is based on commonly accepted investment categories for proper diversification. So the recommendation is guidance based on their inputs meant to protect and empower them.

Providing the asset allocation recommendation is just the first step, the selection of an investment advisor is next (the investment advisor is analogous to a guide). This is where the investor can exercise their discretion over delegating the responsibility to a firm in charge of selecting the proper investments within the back drop of the selected asset allocation (this action is analogous to a student, with a major, selecting their course professors). Investors can review the portfolio models managed by a variety of portfolio model managers. A “portfolio model” is a virtual portfolio that is managed by a portfolio model manager. A “portfolio model manager” is an investment advisor that selects various securities for each asset class in the prescribed asset allocation, from the investments available on the platform (which can be approved by a committee).

The investor has the ability to couple their account to the portfolio model manager of their choosing. They will receive notifications each time there is a change in the portfolio model that directly affects their account. The notifications will include a link to a Facebook page that will allow investors to share their thoughts about the decision and the opportunity for the portfolio model manager to defend the change. Based on the opinion of the investor, they can elect to change the portfolio model at anytime.

PROVIDING ASSURANCES

Since the cornerstone of the investor’s portfolio management is the adherence to the prescribed asset allocation for controlling risk and providing profit potential, vigilant monitoring of a portfolio model’s current asset allocation is essential. So the solution must monitor the portfolio model’s composition throughout the trading day and when the composition meets certain conditions, a rebalancing action is executed.

When the investor selects a portfolio model, they can review the range of acceptable tolerances for each asset class and will receive a notification when a rebalancing action occurs. Again, the notifications will include a link to the Facebook page so the investor can post or read feedback about the cause of the rebalancing. And the portfolio model manager can offer insights into the market conditions that affected the investments, causing the changes in portfolio composition.

SOLUTION SUMMARY

Educated consumers of investment advisory services need the tools to make decisions reflecting their personal views but need the assurance that they are within a sandbox that provides guardrails. Our solution provides the proper portfolio composition (asset allocation) that matches their propensity for risk, so they will be able to endure the volatility of markets without the need to liquidate at inopportune times.

Educated consumers of investment advisory services require the opportunity to dictate who manages their investments within their portfolio composition. The decision of selecting a portfolio model manager can be driven by a variety of factors, but investment disciplines can be the greatest of them. These investors understand that applied information must be executed in a logical manner in order to be intelligent.

Educated consumers of investment advisory services expect that technological advancements can be used to conduct routine activities that ensure their goals are adhered to. And anytime anything occurs, related to their account, they would like to be contacted so that they will be able to examine the impact.

Lastly, incorporating the ability for investors to interact with others who share similar or dissimilar views, allows them to enhance their ability to make decisions.

The Complete Platform